In the ever-changing landscape of global economics, the question on many minds is, “Is Canada headed for a recession in 2023?” As we navigate the complexities of the financial world, it’s crucial to stay informed about the current economic situation and what it could mean for the future.

Canada, known for its robust economy and stable financial health, has been a beacon of economic resilience. However, as we enter 2023, there are murmurs about a potential downturn. As various economic indicators suggest possible turbulence, this speculation isn’t without reason. But what does this mean for Canadians and the global economy at large?

I. Introduction

Economic indicators are vital tools for predicting a country’s financial health. They provide a snapshot of a country’s economic performance at a given time, offering insights into trends that can help forecast future economic conditions. These indicators include factors like GDP growth rate, unemployment rate, inflation rate, and many others.

In the case of Canada, these indicators have traditionally painted a picture of economic stability and growth. However, recent trends suggest a potential shift in this narrative. It’s important to note that these indicators are not infallible predictors of a recession but provide valuable insights that can help us prepare for potential economic shifts.

Canada’s Financial Health in 2023

As we delve deeper into 2023, we must assess Canada’s financial health. While the country has demonstrated economic resilience in the past, current indicators suggest a potential slowdown. This doesn’t necessarily mean a recession is imminent, but it does warrant a closer look at the country’s economic trajectory.

The Importance of Staying Informed

Understanding the economic landscape is more important than ever in these uncertain times. It allows us to make informed decisions, whether it’s about personal finances, business investments, or policy-making. By keeping a close eye on economic indicators and trends, we can better navigate the potential challenges and opportunities that lie ahead.

As we continue to explore the question, “Is Canada headed for a recession in 2023?” it’s important to remember that economics is a complex field with many variables. While we can use indicators to make educated predictions, the future is never set in stone. However, we can prepare for the future by staying informed and understanding the dynamics at play.

II. Understanding the Current Economic Forecast in Canada

As we delve into the heart of 2023, the economic forecast for Canada has become a topic of intense discussion among economists, investors, and policymakers alike. The Canadian economy, known for its resilience and stability, shows signs that have led to speculations about a potential economic slowdown or recession.

Overview of the Economic Forecast Canada 2023

The economic forecast for Canada in 2023 is a mixed bag. On the one hand, the country continues to benefit from strong domestic demand, a robust housing market, and a resilient financial system. On the other hand, there are concerns about slowing global growth, trade tensions, and the potential impact of the COVID-19 pandemic’s lingering effects.

The Bank of Canada, in its monetary policy report, has projected a modest growth rate for the year. However, it has also warned about the risks associated with high household debt and imbalances in the housing market. These factors and external uncertainties have led to a cautious outlook for Canada’s economy in 2023.

Explanation of Canada Economy 2023 Prediction

Predicting the trajectory of an economy is a complex task that involves analyzing a multitude of factors. For Canada in 2023, economists are closely watching several key indicators. These include the unemployment rate, inflation rate, GDP growth, and housing market trends.

While some of these indicators show positive signs, others raise concerns. For instance, the unemployment rate has gradually decreased, which is a positive sign. However, inflation has been on the rise, potentially impacting consumer spending and overall economic growth.

Discussion on the Possibilities of Canada Heading for a Recession

The question of whether Canada is heading for a recession in 2023 is a complex one. A recession is typically defined as a significant decline in economic activity spread across the economy, lasting over a few months. This is usually visible in real GDP, income, employment, industrial production, and wholesale-retail sales.

While some indicators suggest a potential slowdown, it’s important to note that it does not necessarily equate to a recession. Economists are closely monitoring the situation, and while there is concern, there is also a belief that Canada’s strong economic fundamentals could help it navigate these challenging times.

- Is there a Risk of Recession in Canada?

The risk of a recession in Canada, as in any country, is always present. Economies are dynamic and influenced by many factors, both domestic and international. Currently, rising inflation and high household debt are areas of concern. However, it’s important to note that these factors alone do not guarantee a recession. They are simply indicators that economists use to assess the economy’s health.

- Canada’s Economic Slowdown 2023

The potential economic slowdown in Canada in 2023 is a topic of concern. While the country’s economy has shown remarkable resilience in the past, the current indicators suggest that the pace of growth may slow down. This could be due to various factors, including slowing global growth, trade tensions, and the potential impact of the COVID-19 pandemic’s lingering effects.

Importance of Keeping an Eye on the Recession Indicators Canada 2023

In these uncertain times, keeping an eye on recession indicators is more important than ever. These indicators, which include factors like the unemployment rate, inflation rate, and GDP growth, can provide valuable insights into the economy’s health. By monitoring these indicators, we can better understand the economic landscape and make informed decisions about our financial future.

As we continue to navigate 2023, staying informed and prepared is crucial. While the economic forecast may seem daunting, it’s

important to remember that economies are dynamic and constantly changing. By visiting informed and understanding the dynamics at play, we can better navigate the potential challenges and opportunities that lie ahead.

III. Detailed Analysis of the Canadian Economy

As we continue to explore the economic landscape of Canada in 2023, it’s crucial to delve deeper into the key indicators that shape the country’s financial health. From GDP forecasts to unemployment rates, real estate market trends, and the value of the Canadian dollar, each of these factors plays a significant role in the overall economic picture.

Discussion on the Canada GDP 2023 Forecast

Gross Domestic Product (GDP) is a vital measure of a country’s economic performance. For Canada, the GDP forecast 2023 is a topic of intense scrutiny. The Bank of Canada, in its monetary policy report, has projected a modest growth rate for the year. However, this projection is accompanied by caution due to potential risks associated with high household debt and imbalances in the housing market.

Analysis of Unemployment Rate Forecast Canada 2023

The unemployment rate is another key indicator of economic health. A lower unemployment rate typically signifies a healthier economy. For Canada in 2023, the unemployment rate has been gradually decreasing, which is a positive sign. However, it’s essential to monitor this trend closely, as changes in the unemployment rate can have significant implications for the overall economy.

The Implication of Changes in the Canadian Real Estate Market 2023

The real estate market often reflects a country’s economic health. In Canada, the housing market has been robust, contributing significantly to the country’s economic growth. However, there are concerns about potential imbalances in the housing market. High household debt and rising house prices could pose risks to financial stability. Keeping a close eye on these trends is crucial, as they could have significant economic implications in 2023.

Examination of the Canadian Dollar Value 2023 Prediction

The value of the Canadian dollar is another critical economic indicator. A strong currency can be a sign of a healthy economy. However, it can also make exports more expensive, impacting trade. For 2023, predictions for the Canadian dollar are mixed. While some expect the currency to remain stable, others anticipate potential fluctuations due to external factors such as global economic trends and trade tensions.

Implications of Canada Recession for International Investors

The possibility of a recession in Canada has implications beyond its borders, particularly for international investors. Canada’s economy is closely tied to global markets, and a slowdown could impact investor confidence. However, it’s also important to note that recessions can present opportunities. For savvy investors, periods of economic downturn can offer the chance to invest in undervalued assets.

- Current State: Canadian Economic Health Check 2023

As we move into 2023, the Canadian economy presents a mixed picture. While there are positive signs, such as a decreasing unemployment rate and a robust housing market, there are also areas of concern. High household debt, potential imbalances in the housing market, and uncertainties in the global economic landscape pose challenges.

- Understanding the Canadian Economy 2023

Understanding the Canadian economy in 2023 requires a comprehensive analysis of various economic indicators. From GDP growth and unemployment rates to housing market trends and the value of the Canadian dollar, each of these factors offers insights into the country’s economic health. While there are areas of concern, Canada’s strong economic fundamentals provide a solid foundation for resilience.

Factors Influencing Canada’s Economy in 2023

Several factors are influencing Canada’s economy in 2023. These include domestic factors such as household debt and housing market trends and external factors like global economic trends and trade tensions. Understanding these factors and their potential impact is crucial for forecasting future economic conditions.

IV. The Impact of Possible Recession on Different Sectors

The potential for a recession in Canada in 2023 has raised concerns across various sectors of the economy. From households and small businesses to startups and the job market, a recession could have wide-ranging impacts. This section will explore how a potential economic downturn could affect these different sectors.

How Will the 2023 Recession Affect Canadian Households?

A recession can have significant impacts on households. Reduced economic activity can lead to job losses, reduced income, and increased financial stress. For Canadian homes, the potential recession in 2023 could exacerbate concerns about high household debt levels. Families must prepare for potential economic downturns by building up savings and reducing debt where possible.

How Will Canada’s 2023 Recession Impact Small Businesses?

Small businesses are often particularly vulnerable to economic downturns. A recession can reduce consumer spending, which can hit small businesses hard. In a recession in 2023, Canadian small businesses may face challenges such as reduced revenue and difficulties accessing financing. However, it’s also important to note that downturns can create opportunities for companies that can adapt and innovate.

Impact of Potential Recession on Canadian Startups

With their inherent risks and reliance on funding, startups can be significantly impacted by a recession. Reduced investor confidence can make it harder for startups to secure funding. Additionally, a downturn in the economy can affect consumer spending and demand for new products and services. However, like small businesses, startups that can adapt to changing conditions and find new opportunities may weather a recession.

How Does the Recession Affect the Job Market in Canada?

A recession can have significant impacts on the job market. Reduced economic activity can lead to job losses and increased unemployment. For Canada, a potential slowdown in 2023 could put pressure on the job market, particularly in sectors most affected by the downturn. However, it’s also possible that some industries could see growth during a recession, particularly those that can adapt to changing economic conditions.

Outlook on Canada’s Manufacturing Industry 2023

The manufacturing industry is a key part of Canada’s economy, and a potential recession in 2023 could have significant impacts. Reduced global demand and trade tensions could pose challenges for the industry. However, the sector could also see opportunities, mainly if there are shifts in global supply chains or increased demand for specific products.

Impact of the 2023 Recession on Canada’s Tech Sector

The tech sector has been a bright spot in Canada’s economy, and it could play a key role in the country’s economic recovery in the event of a recession. While a downturn could pose challenges, the tech sector could also see opportunities. The increased reliance on digital technologies during the COVID-19 pandemic has underscored the importance of the tech sector, and this trend is likely to continue even in the face of a recession.

V. Canadian Government’s Measures to Prevent Recession

In the face of a potential economic downturn, the Canadian government has a crucial role. Through fiscal policy and other measures, the government can take steps to mitigate the impacts of a recession and support economic recovery. This section will explore the Canadian government’s actions to prevent a potential slowdown in 2023.

Steps the Canadian Government is Taking to Prevent the 2023 Recession

The Canadian government has a range of tools at its disposal to prevent a recession. These include fiscal policy measures such as government spending and taxation and monetary policy measures such as interest rates and money supply.

In response to the potential for a recession in 2023, the government has indicated that it is prepared to take action to support the economy. This could include increased government spending to stimulate economic activity, tax cuts to boost consumer spending, and measures to help businesses and protect jobs.

Discussion on Canadian Fiscal Policy 2023

Fiscal policy is a key tool that the government can use to influence the economy. In 2023, the Canadian government’s fiscal policy could prevent a recession.

The government could increase spending in areas that stimulate economic activity, such as infrastructure projects. This can create jobs and boost demand in the economy. Alternatively, the government could cut taxes, increasing disposable income and growing consumer spending.

However, it’s important to note that fiscal policy measures can take time to implement and impact the economy. Therefore, these measures must be part of a long-term strategy to support economic stability and growth.

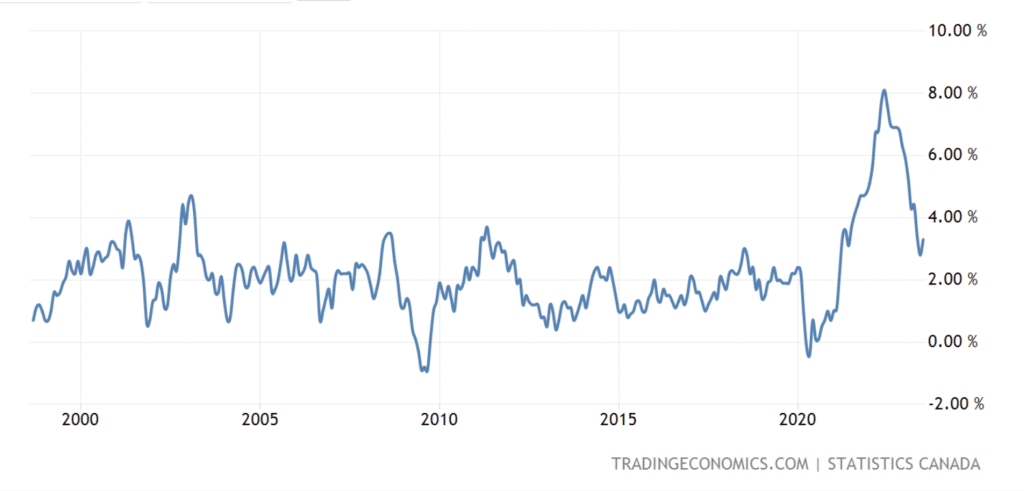

Canada’s Inflation Rate 2023

Inflation is another key economic indicator that the government closely monitors. Inflation refers to the rate at which the general level of prices for goods and services is rising. A moderate level of inflation is generally seen as a sign of a healthy economy. However, high inflation can erode purchasing power and can be a sign of economic instability.

For 2023, the inflation rate in Canada is a topic of concern. Rising inflation could impact consumer spending and overall economic growth. The government, through the Bank of Canada, has tools to manage inflation, such as adjusting interest rates.

Preparing for Canada’s Economic Downturn

In the face of a potential economic downturn, preparation is key. The Canadian government is taking steps to prepare for a possible recession in 2023. This includes closely monitoring economic indicators, implementing fiscal policy measures, and ensuring safety nets are in place to support individuals and businesses.

While it’s impossible to prevent a recession completely, these measures can help to mitigate the impacts of a downturn and support a faster recovery. As we navigate the uncertainties of 2023, the government, businesses, and individuals must stay informed and be prepared for the potential challenges ahead.

VI. Navigating the Potential Economic Challenges

As we delve into the potential economic challenges that Canada may face in 2023, it’s crucial to understand how to navigate these uncertainties. From understanding the predicted economic changes to preparing for a potential recession, this section will provide insights on navigating these challenges.

Predicted Economic Changes in Canada 2023

In 2023, Canada may face several economic changes. These could include a slowdown in economic growth, changes in the job market, fluctuations in the housing market, and potential shifts in the value of the Canadian dollar. Understanding these changes and their potential impacts can help individuals, businesses, and policymakers make informed decisions.

- Investment Strategies for Canada Recession 2023

Having a sound investment strategy is crucial in the face of a potential recession. This could involve diversifying your portfolio, investing in recession-resistant sectors, or taking a more conservative approach. Keeping a long-term perspective and avoiding making rash decisions based on short-term market fluctuations is also essential.

- What to Do if Canada Goes into Recession in 2023?

If Canada goes into recession in 2023, it’s important to stay calm and make informed decisions. This could involve tightening your budget, building up an emergency fund, and seeking professional financial advice. For businesses, it could include reducing costs, diversifying revenue streams, and adapting to changing market conditions.

Potential Effects of the 2023 Recession on the Canadian Education System

A recession can have impacts beyond the economy, including on the education system. Reduced government revenues could lead to cuts in education funding. However, a recession could increase demand for education and training as individuals seek to improve their skills and employability.

Financial Preparedness for the Canadian Recession

Financial preparedness is crucial in the face of a potential recession. This involves clearly understanding your financial situation, building up savings, reducing debt, and planning to deal with possible job loss or reduced income. It’s also essential to stay informed about the economic situation and seek professional advice.

VII. How BHM Financial Group Can Help During Financial Challenges

BHM Financial Group is a beacon of hope for many Canadians in the face of financial challenges. With a history rooted in understanding the financial needs of its clients and a suite of services designed to provide flexible solutions, BHM Financial Group is more than just a lending institution.

Introduction to BHM Financial Group and its History

Founded in 2005, BHM Financial Group has been committed to providing Canadians with financial solutions that are both accessible and flexible. The company’s unique approach to lending, which is based on assets rather than credit ratings, has allowed it to serve a diverse range of clients.

Services Offered by BHM Financial Group

BHM Financial Group offers various loan services, each designed to meet the unique needs of its clients. These include:

- Car Title Loans: BHM provides loans based on the value of your car. This allows you to access funds quickly while still keeping your vehicle.

- Mobile Home Loans: If you own a mobile home, BHM can provide a loan based on its value, offering a financial solution that leverages your assets.

- Truck Loans: Truck owners can take advantage of BHM’s truck loans, which provide funds based on the truck’s value.

- Trailer Loans: BHM offers loans for trailer owners, providing a financial solution that considers the trailer’s value.

- RV Loans: If you own an RV, BHM can provide a loan based on its value, offering a flexible financial solution.

- Horse Trailer Loans: BHM offers loans based on the trailer’s value, providing a unique financial solution for those with a horse trailer.

- Farm Equipment Loans: BHM understands the value of farm equipment and offers loans based on this, providing a solution tailored to the needs of farmers.

- First Mortgages: BHM offers first mortgages, providing a financial solution for those looking to purchase a home.

- Second Mortgages: If you already own a home, BHM can provide a second mortgage based on the equity in your home.

- Small Business Loans: BHM offers loans for small businesses, providing a financial solution to help companies grow and succeed.

- Boat Loans: If you own a boat, BHM can provide a loan based on its value, offering a unique financial solution.

The Company’s Mission and Target Clients

BHM Financial Group’s mission is to provide accessible financial solutions to all Canadians, regardless of their credit history. The company’s unique approach to lending allows it to serve a diverse range of clients, including those who might not qualify for traditional loans.

BHM’s Unique Approach to Providing Loans Based on Assets

BHM’s approach to lending is simple: if you have an asset, you can get a loan. The company provides loans based on the value of various investments, from vehicles to real estate. This approach allows BHM to deliver flexible loan options tailored to each client’s needs.

Real-Life Examples of How BHM Has Helped Canadians in Financial Crises

Over the years, BHM has helped countless Canadians navigate financial crises. For example, a small business owner was able to secure a loan using their company vehicle as collateral, allowing them to cover unexpected expenses and keep their business running. In another case, a family could use their car to secure a loan, providing them with the funds needed to cover emergency medical expenses.

VIII. Conclusion

As we navigate the uncertainties of 2023, whether Canada is headed for a recession remains at the forefront of economic discussions. The mixed signals from various economic indicators paint a complex picture that requires careful analysis and thoughtful consideration.

Final Thoughts on the 2023 Canada Economy Predictions

Predicting the trajectory of an economy is a complex task that involves analyzing a multitude of factors. For Canada in 2023, these predictions range from modest growth to a potential economic slowdown. While some indicators suggest a robust economy, others hint at possible challenges. However, it’s important to remember that these predictions are just predictions. They are not set in stone; various unforeseen factors can influence the economic outcome.

Importance of Monitoring the Signs of Recession in Canada 2023

Monitoring the signs of a potential recession is crucial in these uncertain times. Economic indicators such as GDP growth, unemployment rate, inflation rate, and housing market trends can provide valuable insights into the economy’s health. Individuals, businesses, and policymakers can better understand the economic landscape and make informed decisions by keeping a close eye on these indicators.

Encouragement for Individuals and Businesses to Prepare and Seek Professional Financial Advice

In the face of potential economic challenges, preparation is key. This involves clearly understanding your financial situation, building up savings, reducing debt, and having a plan to deal with potential job loss or reduced income. For businesses, this could involve finding ways to reduce costs, diversify revenue streams, and adapt to changing market conditions.

Seeking professional financial advice can also be beneficial. Financial advisors can provide personalized advice based on your circumstances and help you navigate financial challenges. Organizations like BHM Financial Group can offer flexible financial solutions to help individuals and businesses weather potential economic downturns.

In conclusion, while the possibility of a recession in Canada in 2023 is a concern, it’s not a foregone conclusion. By staying informed, preparing for potential challenges, and using available resources, individuals and businesses can confidently navigate these uncertain times.

Frequently Asked Questions (FAQs)

- What is the economic forecast for Canada in 2023?

The economic forecast for Canada in 2023 is mixed, with some indicators suggesting modest growth and others hinting at a potential slowdown. The actual outcome will depend on various factors, including global economic trends, domestic economic policies, and the ongoing impact of the COVID-19 pandemic.

- What are the signs of a potential recession in Canada?

Symptoms of a possible slowdown in Canada include a significant decline in GDP growth, an increase in the unemployment rate, high inflation, and imbalances in the housing market. However, these indicators are not definitive, and a combination of factors usually triggers a recession.

- How could a recession in Canada affect households and businesses?

A slump in Canada could lead to job losses, reduced income, and increased household financial stress. For businesses, a recession could result in reduced consumer spending, difficulties accessing financing, and potential business closures.

- What measures is the Canadian government taking to prevent a recession?

The Canadian government can use fiscal policy measures, such as government spending and taxation, to stimulate the economy and prevent a recession. The government can also use monetary policy measures, such as adjusting interest rates and controlling the money supply, to manage inflation and stabilize the economy.

- How can individuals and businesses prepare for a potential recession?

Individuals can qualify for a possible recession by building up savings, reducing debt, and seeking professional financial advice. Companies can prepare by finding ways to reduce costs, diversify revenue streams, and adapt to changing market conditions.

- What is BHM Financial Group’s approach to lending?

BHM Financial Group provides loans based on the value of various types of assets, from vehicles to real estate. This approach allows BHM to deliver flexible loan options tailored to each client’s specific needs, regardless of their credit history.

- How can BHM Financial Group help during financial challenges?

BHM Financial Group can provide flexible financial solutions to help individuals and businesses navigate economic challenges. The company offers various loan services based on the value of multiple types of assets, allowing clients to access funds quickly and easily.

- What impact could a recession have on the Canadian education system?

A recession could lead to reduced government revenues, resulting in cuts in education funding. However, a recession could also increase demand for education and training as individuals seek to improve their skills and employability.

- How does a recession affect the job market?

A recession can lead to job losses and increased unemployment as businesses cut costs and reduce their workforce. However, some sectors may see growth during a downturn, particularly those that can adapt to changing economic conditions.

- What investment strategies could be beneficial during a recession?

During a recession, it can be helpful to diversify your investment portfolio, invest in recession-resistant sectors, and maintain a long-term perspective. It’s also essential to avoid making rash decisions based on short-term market fluctuations.